INVEST IN FINE WINE

How to Succeed in a Proven, Profitable & Secure Alternative Investment

With low volatility, high returns, and a tangible asset that appreciates over time - now is the time to take this market seriously.

Take advantage of the markets’ next chapter of growth and discover why there has never been a better time to take advantage of the ultimate alternative investment.

Timing is everything...

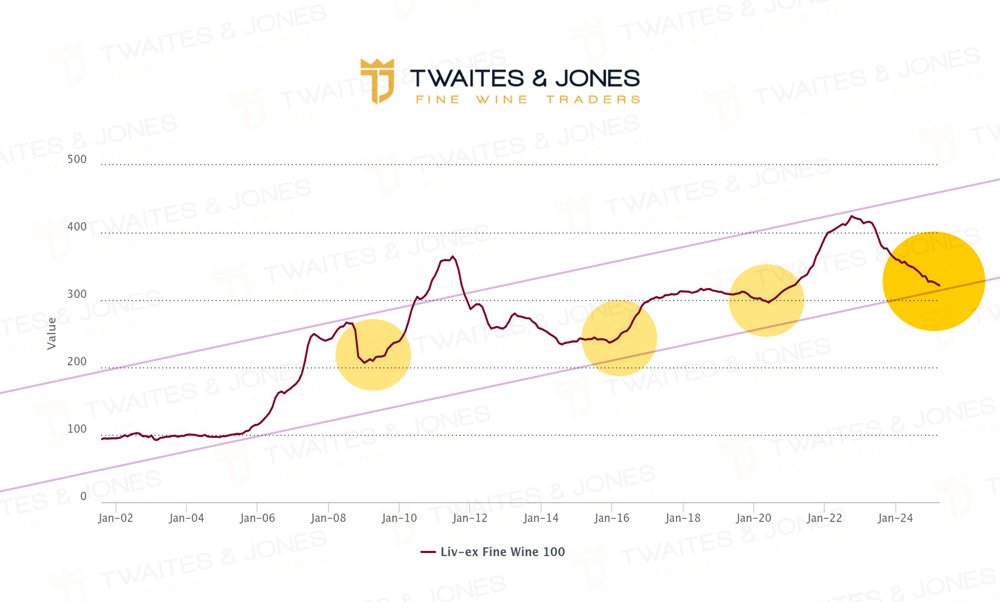

WHY NOW MAY BE THE BEST OPPORTUNITY FOR MORE THAN 20 YEARS TO INVEST IN THE MARKET

The cyclical nature of this market is now pointing towards a clear buying window of opportunities...

Every investor dreams of buying in a proven dip. Independent (Liv-ex) historical and current trading data is now pointing towards a strong window of opportunities.

Based on independent market trading data (Liv-ex), there are clear indicators that the fine wine investment market may be ready to climb out of its current dip. Other investment markets have been heavily rocked by recent 2025 events and look particularly unsteady, but fine wine is trending very similar to past performances.

HISTORICAL TRADING DATA CLEARLY POINTS TO STRONG LONG-TERM GROWTH WITH 10-12% PER ANNUM***

What would your investment look like over the past 20 years?

If you invested £10,000 in January 2005 your investment would be worth***

*** Data sourced from Liv Ex 100 Index - £10,000 invested January 2005. Valuations track index points on every 1st January from 2005 to 2025.

Past performance is not a guarantee of future performance. The value of your investment could decrease as well as increase.

Why investing in fine wine is so attractive

If you are looking to for a Safe-Haven to protect yourself from today’s volatile investment environment, then choose Twaites & Jones as your Fine Wine Investment provider. A seamless service that provides a secure and transparent trading experience.

The global wine market size was estimated at USD 515.1 billion in 2024 and is projected to grow at a CAGR of 8.1% from 2025 to 2030 (Source: grandviewresearch.com)

Historical Performance

Low Volatility

Supply & Demand

Asset Backed

Inflation Proof

U.K. Tax Efficiency

Average annual returns of 10-12%***

*** Data sourced from Liv Ex 100 Index - £10,000 invested January 2005. Valuations track index points on every 1st January from 2005 to 2025.

Past performance is not a guarantee of future performance. The value of your investment could decrease as well as increase.

How does fine wine compare as an investment?

Stability

Fine wine appreciates steadily, unlike crypto’s extreme volatilityTangible Asset

Wine is a physical product, while crypto exists only digitallyLower Correlation to Markets

Wine investment is not affected by the same factors that cause crypto crashesMarket Maturity

The wine market has centuries of proven performance, unlike crypto’s uncertaintyLiquidity

While crypto can be highly liquid, the fine wine secondary market is growing with increasing investor demandLong-Term Appreciation

Wine ages and improves in value over time, while whiskey generally has a fixed aging processConsistent Demand

Fine wine markets are far more globally established than whiskey investmentDiversification

Wine offers broader regions, vintages, and growth potentialLower Storage & Maintenance Costs

Unlike whiskey casks, fine wine storage is straightforward and cost-effectiveFine wine vs Currency (Forex)

Why Wine is a Safer Alternative to

Currency Trading

Lower Risk & Volatility

Forex trading is highly speculative, while fine wine offers stable, predictable growthLong-Term Value Growth

Wine investments appreciate steadily over time, unlike short-term currency fluctuationsTangible Asset vs Speculation

Forex relies on economic events, while wine is backed by historical demand and scarcityMarket Independence

Fine wine is not affected by central bank policies or geopolitical eventsLower Entry Costs

Fine wine investments require significantly less capital than real estateTax Benefits

Capital gains tax exemptionsHigher Liquidity

No need to wait for buyers—wine investment markets are more accessible than real estate transactionsNo Maintenance Hassles

No property upkeep, tenants, or legal fees—just asset appreciationGlobal Market Reach

Unlike real estate, fine wine investment is not tied to one geographical areaWelcome to Twaites & Jones Fine Wine Traders

Fine Wine Investment Experts

Your trusted trading partner - with over 40 years of market trading experience to share

Chris Twaites

Oliver Jones

Specialising in the great wines of Bordeaux and the world’s finest and rarest wines. Based in the heart of England, our unique and dedicated services focus on generating maximum returns as well as protecting clients from an often-opaque trading environment.

Twaites & Jones share over 40 years of valuable trading experience, knowledge and access to vast independent market data, allowing us to create strong and balanced portfolios.

Our bespoke, hands-on approach has helped a diverse range of investors, from first-time buyers to high-net-worth individuals and even celebrities, to capitalise on this high-performing asset class.

Due to the structure and efficiency of our services and operations, we hold an enviable position as an independent global player in the Fine Wine markets. Our extensive and secure trading networks deliver a seamless experience for our clients.

- £15M+ STOCK OVERSEEN FOR PRIVATE & CORPORATE CLIENTS

- EXTENSIVE GLOBAL NETWORK

- PORTFOLIO MANAGEMENT PORTAL

- LEGAL TITLE & OWNERSHIP VERIFICATION

- SECURE STORAGE SOLUTIONS INCLUDE TWO-WAY AUTHENTICATION RELEASE PROCESS

- SEAMLESS FROM ENTRY TO EXIT POINT

We have the scale and network to facilitate our private clients, as well as corporate institutions who seek to build portfolios from a few thousand, up to and beyond multi-million-pound levels.

All our Terms & Conditions, as well as our contractual systems, practices and procedures, are in accordance with advice received from Andrew Park of APP Wine Law, the specialist UK Wine Trade Law Firm.

Proud Members and Data Licensee Since 2010 (London International Vintners Exchange)

We are members of the WSTA (Wine and Spirit Trade Association)

Our preferred storage partners – LONDON CITY BOND (EATON PARK)

BBC West Midlands

Contact us today to arrange a friendly no obligation conversation to find out why now may be the best opportunity for more than 20 years to invest in the fine wine markets, with Twaites & Jones – your trusted fine wine trader

Fine wine investment FAQ

Ready to secure your financial future with fine wine investments?

So that we can ascertain your enquiry is genuine, please provide a working telephone number and convenient time for us to call and verify your request before sending out information.

Our time is extremely precious, and we are sure that you will understand and appreciate this fair and sincere request.

Get your free fine wine investment guide from Twaites & Jones